Your credit score holds immense significance in your financial life, making it arguably the most crucial number to keep track of. Fortunately, these days, checking your credit score has become more accessible than ever before.

Before you decide to apply for a new credit card, personal loan, or mortgage, being aware of your credit score becomes vital. It provides valuable insights into the products you may be eligible for and the interest rates you can expect.

The best part is that checking your credit score does not have any negative impact on your credit. In fact, it’s a wise practice to make it a regular habit, even if you’re not actively applying for credit.

Interestingly, the act of monitoring your credit score can actually contribute to its improvement. Regular checks allow you to promptly detect any potential fraud or errors on your credit report. This early detection empowers you to take timely action to resolve any issues that may arise.

To provide you with a comprehensive understanding of your credit score, Trendbbq.com has compiled all the essential information you need to know about how to check your credit score. Being well-informed about your credit score empowers you to make better financial decisions and stay ahead in managing your financial health.

Table of Contents,

- 1. What is a credit score?

- 2. Types of credit scores: FICO vs. VantageScore

- 3. How are credit scores calculated?

- 4. How to check your credit score

- 5. Which credit score should you check?

- 6. What is a good credit score?

- 7. What doesn’t impact your credit score?

- 8. What’s the difference between a credit score and a credit report?

1. What is a credit score?

Your credit score is a three-digit number usually ranging from 300 to 850, holds significant importance as it reflects your creditworthiness and ability to repay loans. Lenders rely on this magic number to assess your potential credit risk.

Several factors contribute to your credit score, including your payment history and the length of your credit history, derived from your current and past credit accounts. These factors are carefully analyzed to determine your creditworthiness.

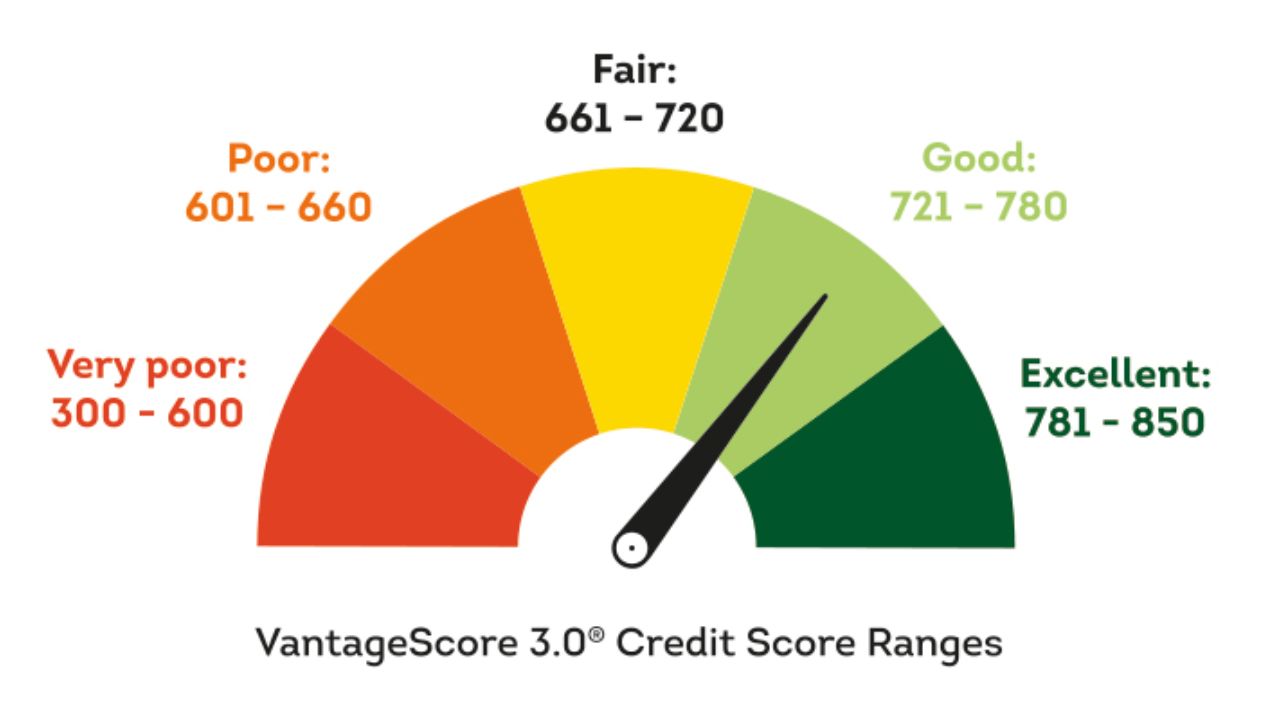

Credit score ranges can vary depending on the scoring model used (FICO or VantageScore) and the credit bureau (Experian, Equifax, and TransUnion) that provides the score. Ratings typically fall into categories like bad/poor, fair/average, good, and excellent/exceptional, based on your credit score. The specific rating you receive will depend on your credit score.

To understand which rating category you belong to, you can refer to estimates from Experian. Knowing your credit rating can help you make informed financial decisions and work towards improving your creditworthiness.

| Rating | Credit Score |

|---|---|

| Very poor | 300-579 |

| Fair | 580-669 |

| Good | 670-739 |

| Very good | 740-799 |

| Exceptional | 800-850 |

2. Types of credit scores: FICO vs. VantageScore

In the world of credit scoring, two prominent models stand out: FICO and VantageScore. While both models evaluate creditworthiness using a scale from 300 to 850, FICO holds a dominant position, being utilized in more than 90% of lending decisions in the United States.

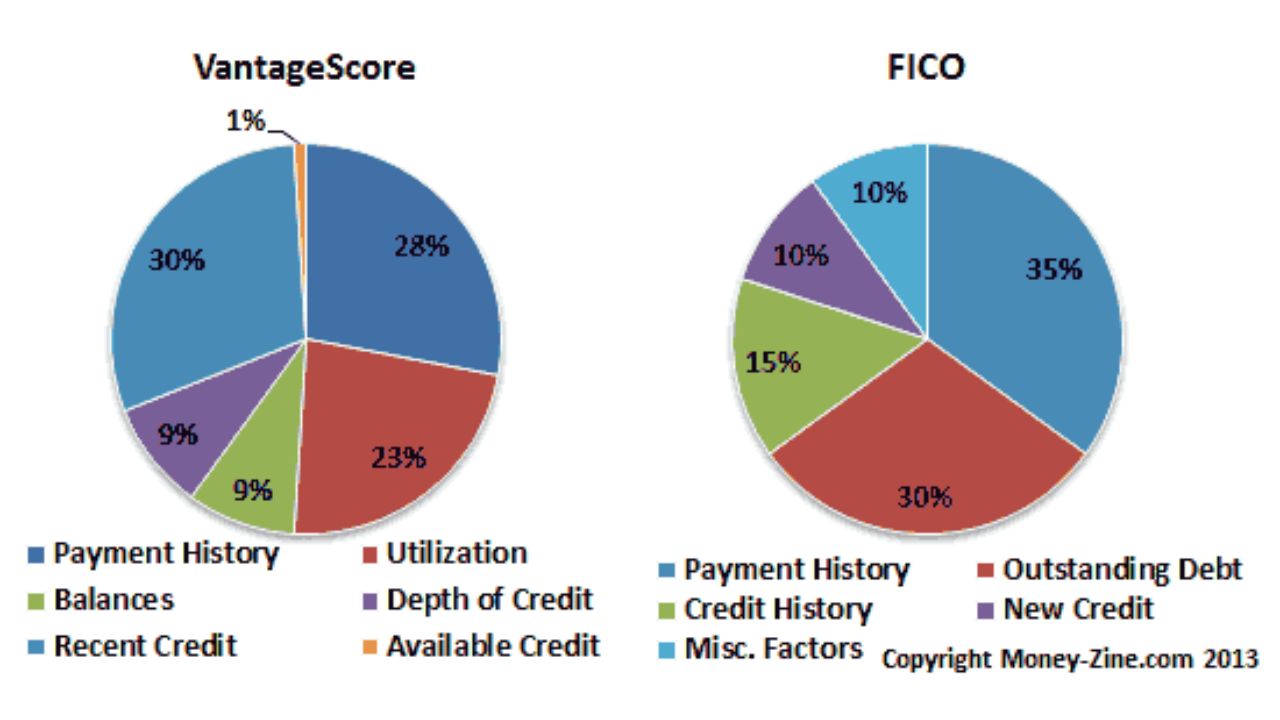

Both FICO and VantageScore credit scores share commonalities, such as considering payment history as the most significant factor in determining a person’s score. However, they diverge in their specific approach to weighing and ranking various other factors that contribute to the final credit score. Each model has its unique methodology and criteria for assessing an individual’s credit risk.

3. How are credit scores calculated?

When it comes to credit scores, the calculation method varies depending on the credit scoring model being used. Let’s take a look at the key factors considered by both FICO and VantageScore.

FICO credit score:

- Payment History (35%): This factor assesses whether you have a history of making timely payments on past credit accounts.

- Amounts Owed (30%): FICO evaluates the total amount of credit and loans you are currently using compared to your total credit limit, commonly referred to as your credit utilization rate.

- Length of Credit History (15%): The length of time you have had credit accounts is taken into account, considering both the age of your oldest account and the average age of all your accounts.

- New Credit (10%): FICO considers how frequently you apply for and open new credit accounts, as multiple recent inquiries may impact your score.

- Credit Mix (10%): This factor looks at the variety of credit products you have, such as credit cards, installment loans, mortgage loans, and more.

VantageScore:

VantageScore’s credit score calculation considers the following factors with varying degrees of influence:

- Extremely Influential: Payment History – Just like FICO, VantageScore places significant emphasis on your track record of timely payments.

- Highly Influential: Type and Duration of Credit, Percent of Credit Limit Used – VantageScore weighs the type of credit you have and the duration of your credit history, along with your credit utilization rate.

- Moderately Influential: Total Balances/Debt – The total amount of outstanding balances or debt you owe is moderately influential in your VantageScore.

- Less Influential: Available Credit, Recent Credit Behavior, and Inquiries – VantageScore considers available credit, recent credit activities, and the number of credit inquiries, but these factors have a relatively lower impact on your overall score.

Both credit scoring models analyze these factors to assess an individual’s creditworthiness, providing lenders and financial institutions with valuable insights to make informed lending decisions.

4. How to check your credit score

To obtain your credit score report, you can visit websites like My Credit File and Check Your Credit, where you can request it for free. During the process, they will require you to verify certain information, such as your name, date of birth, contact address, and driver’s license number. Once you’ve provided the necessary details, you can expect to receive your credit score report within approximately 10 days. This report will give you valuable insights into your credit history and current financial status, enabling you to make informed decisions about your financial health.

5. Which credit score should you check?

According to credit expert John Ulzheimer, who has experience with FICO and Equifax, it’s advisable to check both your FICO and VantageScore credit scores to gain a comprehensive understanding of how lenders may perceive your creditworthiness. Since different lenders may use different scoring models, being aware of both scores can be beneficial. Besides, checking your credit score comes at no cost, making it a valuable practice that can only work to your advantage. Knowing where you stand financially can empower you to make informed decisions about your credit and financial well-being.

6. What is a good credit score?

Defining what constitutes a good credit score can be quite subjective, as it varies depending on different credit scoring models used by lenders. These models come with diverse score ranges, and each lender sets its own standards for rating credit scores.

However, in general, credit scores in the high 600s to mid-700s (on a scale of 300 to 850) are typically regarded as good. It’s important to note that this is a broad guideline, and specific lenders may have varying criteria for what they consider a good credit score.

7. What doesn’t impact your credit score?

Credit expert John Ulzheimer highlights some common misconceptions about what truly impacts your credit score. One prevalent misconception is that information about your wealth, such as income, retirement account balances, home equity, or net worth, plays a role in determining your credit scores. However, these factors are not considered when calculating your creditworthiness.

Additionally, there are several other aspects that do not affect your credit score, including personal factors such as race, religion, nationality, gender, marital status, and age. Similarly, non-financial aspects like political affiliation, education, occupation, job title, employer, employment history, and residential address have no impact on your credit score. Your total assets, regardless of how significant they may be, also do not influence your creditworthiness.

Understanding these misconceptions is crucial for maintaining a clear perspective on how credit scores are calculated. The focus should be on relevant financial factors, such as payment history, credit utilization, and credit history, which genuinely affect your creditworthiness and can help you make informed decisions about managing your credit responsibly.

8. What’s the difference between a credit score and a credit report?

It’s essential to understand the distinction between your credit score and credit report. While your credit score provides a numerical representation of your creditworthiness, your credit report offers a more comprehensive overview of your credit history and current financial standing. The credit report includes detailed information such as personal details (name, address, Social Security number), credit accounts (payment history, credit limits, outstanding balances), public records (such as liens, bankruptcies, and foreclosures), and inquiries made into your credit history. These credit reports are issued by the three main credit bureaus: Experian, Equifax, and TransUnion.

According to credit expert John Ulzheimer, credit scores act as a summary of your credit report’s health. If you find it challenging to review all three credit reports thoroughly, checking your credit scores can serve as a useful proxy for understanding your credit situation. By regularly monitoring your credit scores, you can gauge your creditworthiness and take necessary steps to maintain or improve it. It’s a practical approach to stay informed about your financial status and make sound financial decisions.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/bn/register-person?ref=WTOZ531Y

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.